Lizz Truss’ first big initiative as leader was to introduce a raft of new fiscal measures to promote growth. These measures included cutting taxes (abolishing the top rate of income tax, and reducing the rate for everyone by 1p), as well as abolishing planned tax increases (national insurance, corporation tax).

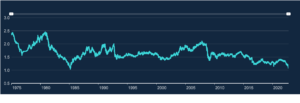

While these would traditionally be red meat policies for Tory voters, the party went into open revolt, Sterling crashed to a record low of 1.03 USD – levels not seen since 1985, interest rates spiked, the bank of England had to bail out the markets to the tune of £65bn and in an unprecedented move for a G7 economy, the IMF very publicly criticised about the UK’s direction.

Spot Exchange Rate: Bank of England

The reason for such a drastic reaction is not entirely down to the policies themselves, there are reasons each one could have a positive impact in isolation. However, there were two very big issues to note with this mini budget.

At a time of severe financial hardship for working people, the prospect of cutting taxes for the very wealthiest in society was viewed in some circles as distasteful, to put it mildly. What kind of a society wouldn’t try to alleviate the suffering for the worst off first of all. Britain has a proud history of supporting the poorest in society, and these policies at this time struck a nerve with the public.

And then there was the financial markets reaction.

The entire package of financial measures was, in the eyes of the markets, unbudgeted. There was no Office of Budgetary Responsibility review to provide independent oversight of the government’s plans, and this lack of transparency and accountability spooked investors.

Furthermore, the government’s expansionary fiscal measures promoting growth were working to oppose the Bank of England’s contractionary monetary actions to quell demand in the economy.

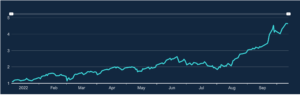

Investors viewed the UK’s financial stability, and ultimately its ability to repay its debt as more precarious than before the mini budget. In their eyes, the UK’s credit worthiness had diminished, and as a result demanded a higher rate of return for UK government bonds. Demand for bonds in circulation dropped, and so did their price, causing their yield to spike to 4.5%

2022 British Government 10 Year Nominal Par Yield: Bank of England

2012-2022 British Government 10 Year Nominal Par Yield: Bank of England

To attract investors with a higher yield is expensive, making it harder still to balance the books, especially when pursuing increasingly expensive policies. Investors bet against the UK economy, and sterling dropped to a record low against the dollar. Expectations rose for further base rate increases to stabilise the exchange rate against the dollar.

Having recognised a ‘significant repricing of UK assets’ and the possibility of major disruption if contagion to the credit conditions spread in the economy, such as defined benefit pension funds being unable to meet their obligations, the Bank stepped in with an emergency bond buying programme aimed at preventing turmoil in the markets.

While this action has been successful in the short term, there remain significant concerns about the direction of travel of this government, and an acceleration in interest rate increases leading to a deeper recession than was otherwise forecast.

When investing your capital is at risk. Past performance is not a guide to future performance. If you invest in currencies other than your own changes in the rate of exchange may affect the value of your investment. This information is for educational purposes and does not constitute advice or a recommendation. You should consider your own personal circumstances when making investment decisions. If you are unsure about how to proceed you should seek professional independent advice.