This year we witnessed extreme weather patterns across the globe, with heat waves and significant flooding ever present. According to the Global Climate Report, summer ‘22 was the hottest on record for Europe and China, the second hottest for North America and Asia, and the fifth hottest globally since records began in 1880.

A lack of effective collaboration amongst world governments and economies to align with the Paris climate agreement will lead to irreversible damage to the planet. To avoid this, greenhouse gas emissions must be reduced by 43% by 2030 in order to stabilise global warming; we take a look at the impact of the climate crisis on ESG investment and what could be done to help.

Demand for ESG

Over recent years there has been a sharp increase in the practice of socially responsible investing (SRI); SRI involves investment strategies that seek to not only maximise returns but also to positively contribute to our society and planet.

The ESG framework has been introduced within finance as a method of objectively measuring and comparing organisations based upon their environmental, social and governance criteria. ESG metrics are therefore used to create a snapshot of current and future attitudes towards planning for sustainable outcomes and mitigating against associated risks.

Increasing numbers of retail and institutional investors have been re-allocating capital towards ESG-focussed funds. In 2021 alone, over $500 billion flowed into them representing an increase of 55% of assets under management in ESG-integrated products, with growth expected to continue. It is clear there are increasing requirements for investment fund managers to have a strong ESG offering to satisfy the rising investor-led demand as a consequence of the climate crisis.

Moreover, global ESG assets could surpass $41 trillion by 2022 and $50 trillion by 2025 – this would represent a third of the projected total assets under management globally, which exemplifies the sheer scale of ESG forces within modern investing.

How is fintech meeting this demand?

Organisations in the fintech space are harnessing the power of technology to provide more personalised ESG products to its customers.

The process of negative screening is one that avoids selection of securities with poorly performing ESG scores when constructing a portfolio, which could lead to the removal of entire ‘sin’ sectors. Accordingly, investors may be exposed to highly concentrated sector allocations, therefore potentially introducing them to greater magnitudes of market risk.

Portfolio optimisation technology has been developed within institutional portfolio management to mitigate against the risk associated with negative screening. Optimisation models construct portfolios customised to the investor and their preferences, including ESG criteria, whilst managing risk by reweighting portfolios to minimise the effects of omitting poorly scoring securities.

By implementing sophisticated modelling, fund managers are able to create SRI-based investment strategies that have strong returns and social performance with lower risk exposure, compared to traditional strategies. With an increasing number of high quality SRI strategies and flows through ESG-integrated products, there are a number of benefits to our society that arise, such as investment into research and development, funding green carbon transition projects and providing early capital to eco-entrepreneurs and start-ups.

Banking on climate chaos

Financial capital is being diverted towards ESG themed projects more than ever, however the climate crisis is worsening – so what is happening?

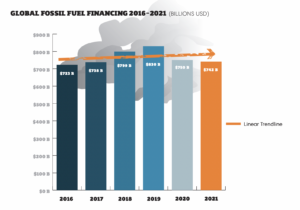

“Fossil fuel financing plateaued last year, yet with levels still higher than in 2016. During this crucial decade for action, when we need the financial sector to rapidly reduce its support for fossil fuels, the overall linear financing trend since Paris is still headed upward.”

Banking on climate chaos report 2022

Annual global climate investment averaged $632 billion per year across 2019 and 2020. In order to limit the earth’s temperature to 1.5 degrees celsius, aligned with the Paris agreement, we must increase spending to at least $4.13 trillion every year by 2030 for an efficient energy transition; current spending is a mere 15% of this target.

The financial services sector is deemed as one of the most significant levers for our low-carbon economic transition, since it has the capabilities to unlock higher volumes of financing for much needed projects previously mentioned.

Since the Paris agreement, US banks have provided nearly $1 trillion in loans towards fossil fuel extraction and its infrastructure, whilst severely underinvesting in ESG projects that benefit our environment. However, banks have increased responsible spending by 154% since 2020, and 63 global banks with $40 trillion in assets have joined the Net-Zero Banking Alliance (NZBA), committing their portfolios to net-zero emissions by 2050.

The dirty dozen

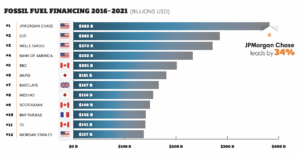

This 2022 report by Banking on Climate Chaos (pg. 8-9) shows how JPMorgan Chase continues to be the world’s worst banker of fossil fuels – this has been true every year since the Paris Agreement.

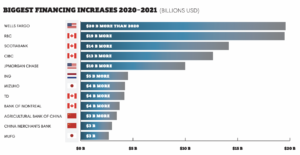

The report also reveals that twenty-six banks trended in the wrong direction last year by increasing their financing of fossil fuels, with Wells Fargo and RBC being the worst culprits.

The modern investment landscape is heavily influenced by the climate crisis, and has seen the rise of SRI strategies, ESG integrated funds and assets to provide a financial vehicle for environmental and social change… let’s try and make steps to increase global engagement.

When investing your capital is at risk. Past performance is not a guide to future performance. If you invest in currencies other than your own changes in the rate of exchange may affect the value of your investment. This information is for educational purposes and does not constitute advice or a recommendation. You should consider your own personal circumstances when making investment decisions. If you are unsure about how to proceed you should seek professional independent advice.